Adding liquidity to a Uniswap pool is becoming a popular way of earning passive returns for blockchain investors. Providing liquidity to decentralized exchanges (or DEXs in short) can be profitable and earn you up to a 20% rate of interest.

However, not all liquidity pools are equal – some of them are more rewarding than others, so it’s necessary to be informed to get the most returns from Uniswap liquidity.

What Are Liquidity Pools?

Liquidity pools are specialized smart contracts which power decentralized exchanges (DEXs) like Uniswap.

Centralized exchanges such as Binance or Coinbase can provide liquidity to the market by simply holding an adequate amount of cryptocurrency in their reserves.

Decentralized exchanges like Uniswap, on the other hand, use automated liquidity pools to make buying and selling digital currencies possible. In other words, DEXs like Uniswap don’t rely on a centralized authority to provide liquidity to the exchange.

The users themselves are responsible for that, and since they get rewarded for staking cryptocurrency in liquidity pools, many blockchain investors consider providing liquidity to Uniswap an efficient way of earning passive income.

Liquidity Staking vs Crypto Mining

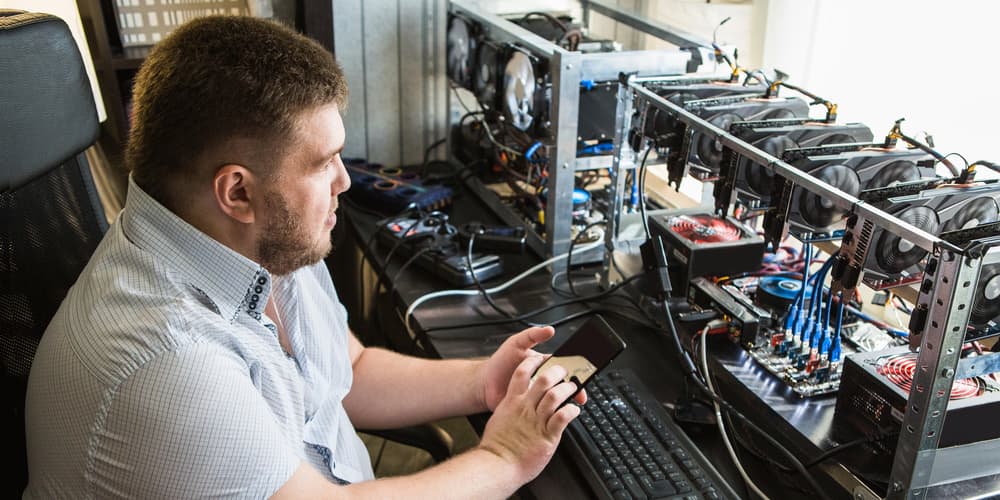

For a long time, crypto mining was the only way in which blockchain enthusiasts could gain access to a source of passive income. While still profitable, mining cryptocurrency is not for everyone as it is costly and complicated.

Mining cryptocurrency requires specialized hardware called “mining rigs”.

A lot of miners build their own mining rigs to remain competitive, but even configuring a pre-made rig can be very problematic for someone who’s not an IT expert.

These require a large initial investment as they cost 1000s of dollars while consuming a lot of electricity. In many countries where energy costs are high, mining crypto is not profitable at all.

Why Liquidity Staking Can Prove a Good Investment

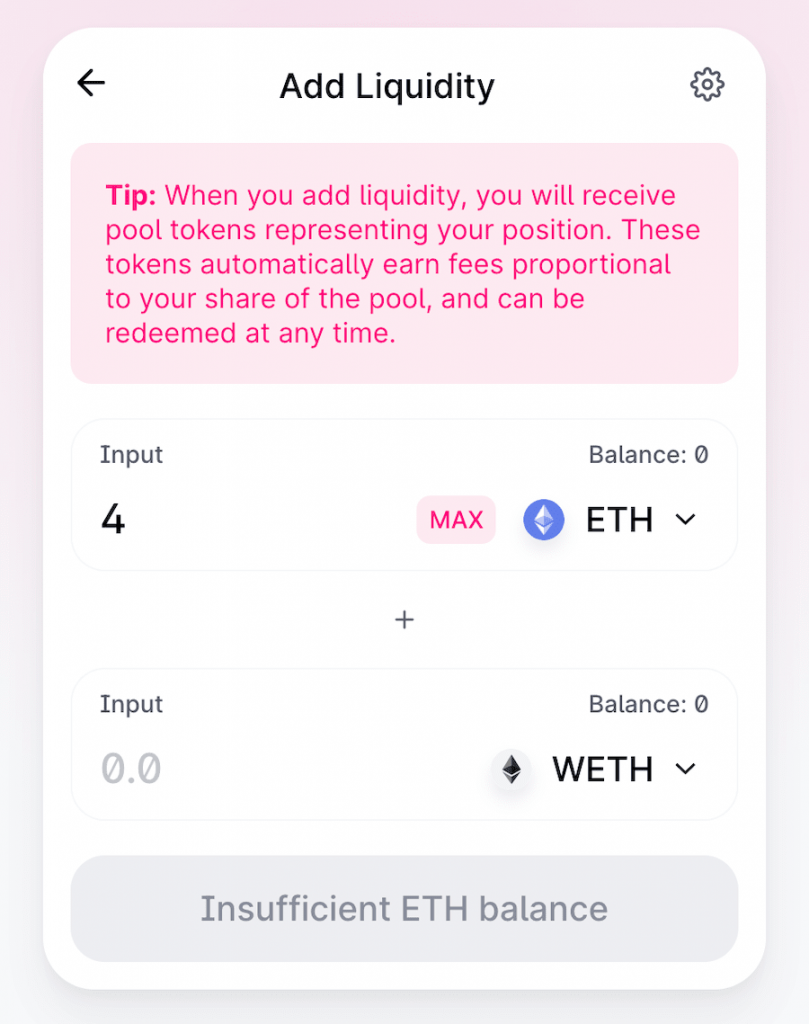

Adding liquidity to Uniswap is much easier – all you have to do is send tokens to a smart contract, and leave them locked there for a period of time.

When you do that, you are essentially lending your funds to Uniswap, so they can be used to keep the exchange working.

In return, you are rewarded with a fraction of the fees paid by Uniswap users whenever they make a transaction. You don’t have to do anything else; you can earn just by keeping your cryptocurrency in a liquidity pool and doing nothing with it.

To add liquidity to Uniswap, send your tokens to a smart contract, and leave them locked there for a period of time. It’s as simple as that

Liquidity staking is not only easier, but also less costly than crypto mining. Adding liquidity to a decentralized exchange is accessible to anyone, as even very small amounts of crypto can be sent to liquidity pools.

Since you don’t have to pay any energy costs, Uniswap liquidity pool returns can be more rewarding than mining returns… No electricity bill to account for!

How Do Uniswap Liquidity Pools Work?

Liquidity pools are advanced smart contracts built on a decentralized blockchain, designed specifically to make operating DEXs like Uniswap possible.

Uniswap allows people to send their tokens to liquidity pools and stake them. Staking simply means leaving the tokens locked in a liquidity pool for a period of time.

As long as you don’t withdraw your funds from the liquidity pool, you are being rewarded for providing liquidity.

When the Uniswap users buy or sell cryptocurrency, they pay a fee.

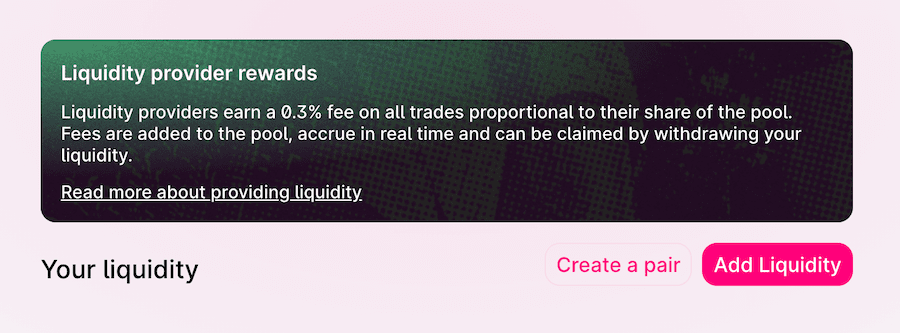

Since Uniswap is a decentralized exchange, the fees paid by the users are then redistributed among liquidity providers.

Everyone who contributes to the exchange by adding liquidity is rewarded proportionally to the amount of funds they stake in liquidity pools.

The Returns of Adding Liquidity To Uniswap Pools

Becoming a liquidity provider is easy.

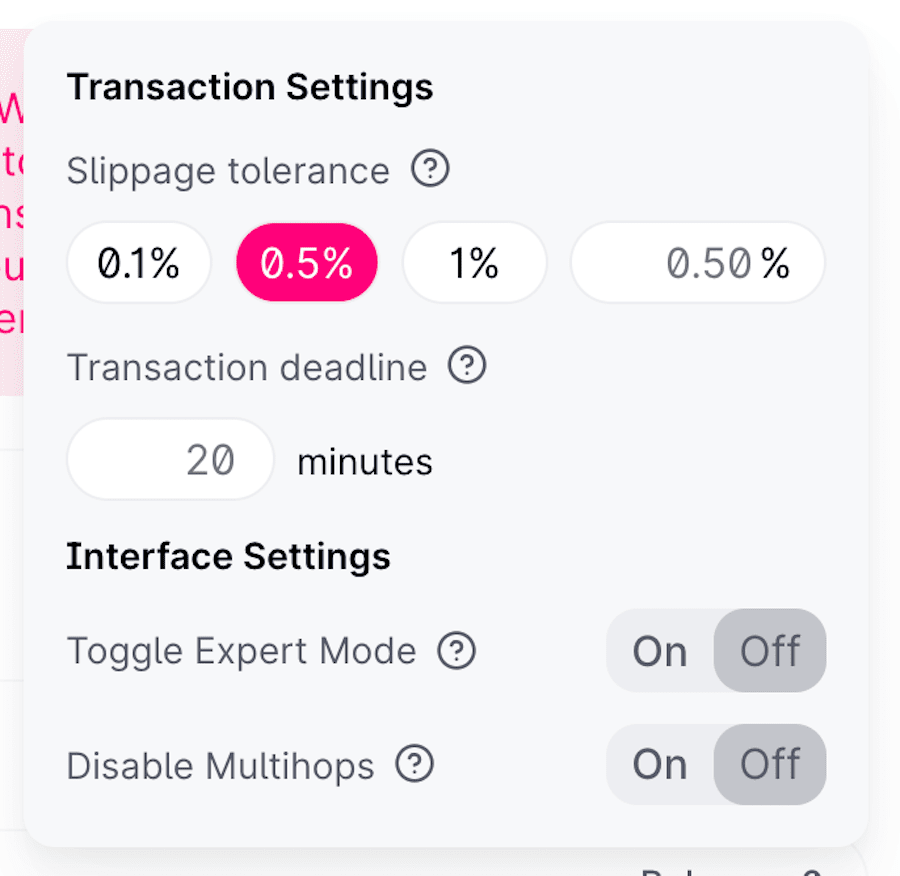

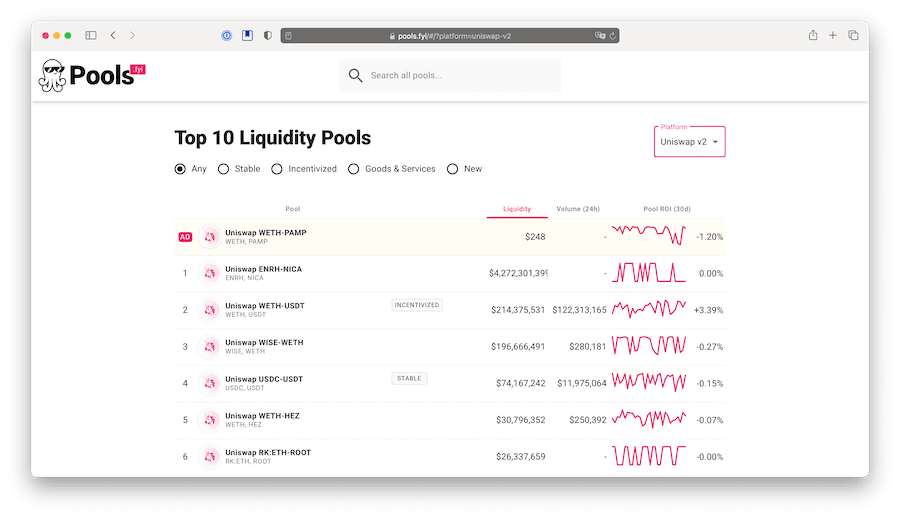

The hard part is choosing the most profitable liquidity pools. If you pick a bad liquidity pool, you will earn as little as 0.01% interest, which makes it not worth the effort. But if you choose a profitable Uniswap liquidity pool, you can get up to a 18.15% return.

To make money by adding liquidity to Uniswap, use a Uniswap liquidity pool returns calculator. Only comparing the returns of different liquidity pools lets you select the one that will allow you to make the biggest gains as the rate of interest of liquidity pools changes over time.

A liquidity pool that gives a phenomenal ROI today might become unprofitable within a month, so it’s essential to check the liquidity pool returns calculator often and always remember to move your tokens to a more profitable pool when you find one.

An Alternative To Uniswap Liquidity Pools

Overall, adding liquidity to Uniswap can be profitable in the long-term, but only if you put constant effort in keeping up to date with which liquidity pools have the best rate of interest at the moment. Otherwise, your profit will be very small.

Adding liquidity to Uniswap is better than just keeping funds in your wallet, but it’s not the best way to multiply your coins. If you are looking for a more profitable way of making money in the crypto space, other options might work better for you.

One of the alternatives to liquidity staking is playing at crypto casinos like Wolf.bet where DEX coins such as SUSHI and UNI are fully-supported and ready for you to roll dice.

Depending on your multiplier and the chance of a roll (or multiple rolls) landing, you can quickly bring your small UniSwap wealth to a sizable amount that you can re-invest in liquidity pools.

Frequently Asked Questions

Liquidity simply means the amount of cryptocurrency necessary for a cryptocurrency exchange like Uniswap to function. In other words, liquidity allows people to buy and sell digital assets smoothly. Without liquidity it would be impossible for any crypto exchange to function, and that’s why you can get rewarded for providing liquidity to Uniswap.

Adding liquidity to Uniswap liquidity pools – also called liquidity staking – means sending your tokens to a smart contract and leaving them locked there for a period of time. When you do that, you essentially lend your funds to Uniswap, and you get rewarded with interest taken from the fees paid whenever Uniswap users buy or sell crypto.

Providing liquidity to Uniswap is rather safe but you can still partially lose your money, the volatility issues can often diminish your rewards and the price swings on the tokens you’re using can make your initial investment decrease, unless you opt to provide liquidity with stable coins. Some liquidity pools can quickly become unprofitable and leaving your tokens there wouldn’t be any better than keeping them in your wallet.