Uniswap is a decentralized exchange that sources its liquidity (liquid assets similar to cash) from users. In exchange for providing liquidity to Uniswap, anyone can earn rewards taken from fees charged per trade.

The platform is the most prominent decentralized exchange in the world. Even more exciting is that back in Sep 2020, Uniswap surpassed Coinbase in daily trading volume.

Given that Uniswap is decentralized, meaning there is no central order book for users to trade with, where does it get the billions of $’s worth in liquidity needed fo?

Unlike centralized exchanges such as Binance, Uniswap crowdsources liquidity from cryptocurrency holders. The way it works is “simple”: Uniswap uses AMM (Automated Market Maker) technology to create decentralized liquidity pools.

These pools contain a pair of tokens, such as ETH and UNI. If you own both ETH and UNI tokens, you can add them to the ETH-UNI pool.

Every time someone uses the ETH-UNI pool to complete a trade, fees are shared with everyone who has added liquidity to that pool.

As you can see, adding liquidity to Uniswap is a massive opportunity to create an additional income source. This guide gives you everything you need to know.

What is liquidity in DeFi?

In DeFi, liquidity refers to how much of a cryptocurrency asset is currently circulating on a given platform or protocol. Put another way; liquidity is just about how much of a certain crypto is available for trade.

When you read about becoming a liquidity provider (sometimes referred to as an LP), all it means is you are supplying the exchange with tokens so that others can trade them.

Think about this in the context of a centralized exchange like Coinbase.

Whether you trade 1 ETH or 10K ETH, the exchange has deep enough liquidity to cover your trade without significant slippage (price differences as your trade eats all the available liquidity at certain prices).

The more liquidity an exchange has, the better price discovery it can offer traders, and the more trades it can actually support.

How Uniswap works & how to profit from it

Uniswap is the largest decentralized exchange globally because it provides excellent liquidity across hundreds of trading pairs. This means that traders can count on Uniswap to offer smooth trades even when they require deep liquidity.

The way Uniswap accomplishes this is by crowdsourcing liquidity using liquidity pools.

Uniswap liquidity pools are made of ERC-20 token pairs such as ETH-SUSHI, ETH-DAI, ETH-USDT, and so on.

When someone wants to trade some of their ETH for SUSHI tokens, they go to the ETH-SUSHI pool, enter the trade amounts, and make the swap. Clearly, this model means that Uniswap relies on people who own the tokens in the pools to actually deposit them there.

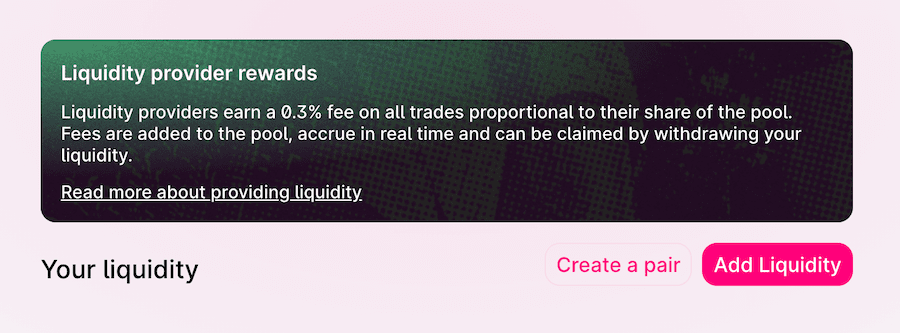

To incentivize people to deposit their tokens in the pools, and thus provide liquidity, Uniswap rewards LPs with LP tokens (Liquidity Provider tokens).

When you deposit to a Uniswap liquidity pool, you are given an LP token in return that represents the underlying tokens (the tokens you deposited).

Every time someone uses the pool for which you have an LP token claim, they pay a 0.3% fee to the pool, and that fee is distributed to the LP token holders for that pool.

When you’re ready to cash out, simply remove liquidity, which gives back your original tokens in a larger quantity than when you deposited them

This is your profit as a liquidity provider.

How to become a liquidity provider on Uniswap

Becoming a liquidity provider on Uniswap enables you to easily profit from the exchange in a secure, reliable way that doesn’t involve trading.

To provide liquidity, follow these simple steps:

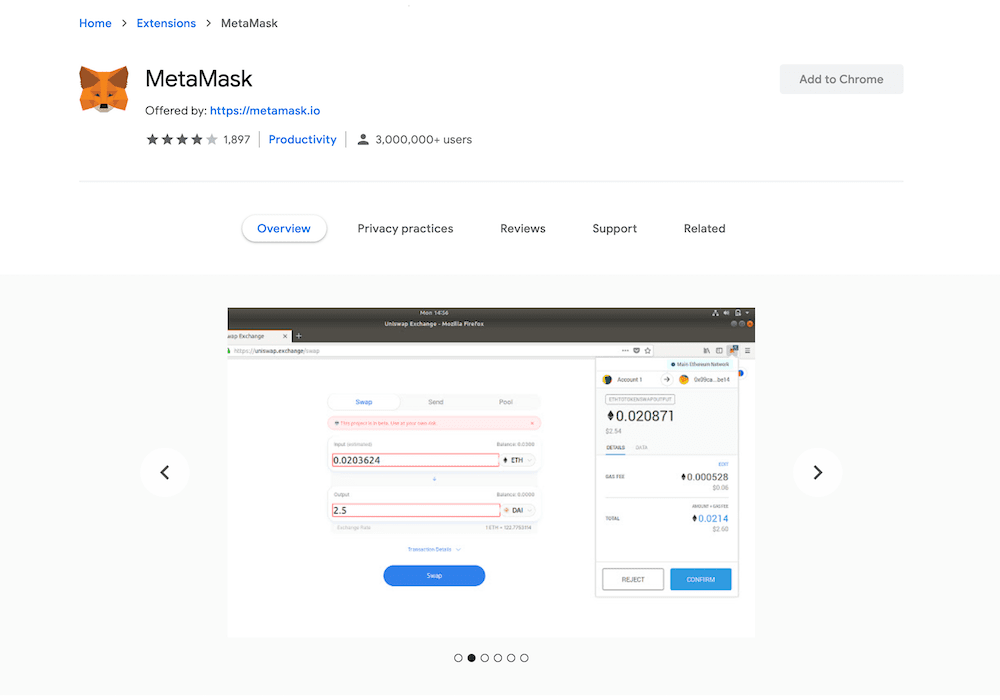

- Install the MetaMask Wallet Chrome extension, then transfer your tokens there. Keep a bit of extra ETH to pay for gas.

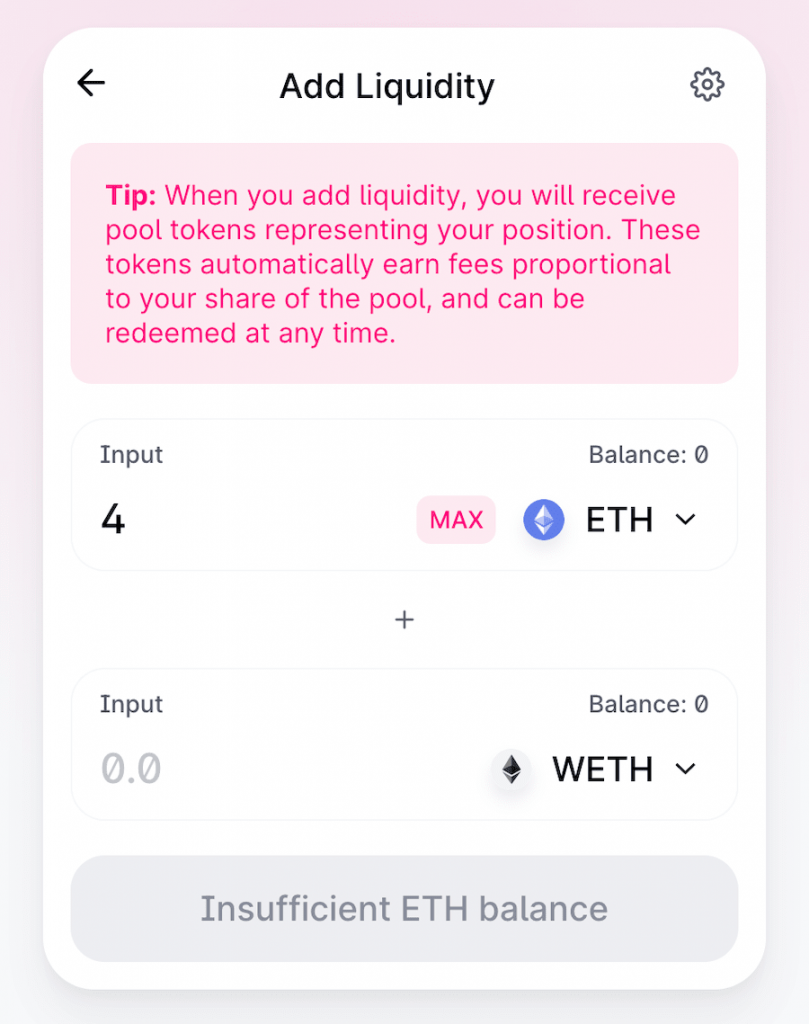

- Head to Uniswap liquidity pools, click Add Liquidity, then search for the tokens you want to add to a pool of your choice.

- Define how much of each token you are adding.

- Click Approve Token, which brings up your MetaMask wallet. Do this for both tokens to enable Uniswap to interact with your tokens.

- After approving both tokens, click Supply, then approve the transaction in your MetaMask wallet, and you’re done with the process.

Once finished, you’ll receive a UNI-V2 token that represents your tokens in the pool.

It’s imperative to keep this token safe because it’s the only way to unlock the tokens you deposited when you’re ready to cash out.

Becoming a Uniswap liquidity provider is a great way to profit from DeFi without the hassle of trading risk. The ultimate benefit to providing Uniswap liquidity is that it puts your otherwise idle crypto assets to work, earning you a passive income.

Frequently asked questions

Liquidity on Uniswap refers to the number of tokens in circulation that are available for trading.

Uniswap price is reflected by the amount of trading volume on the exchange and the expectation that Uniswap will accrue value to UNI token holders.

Uniswap makes money by charging a 0.3% transaction fee on all trades. It then pays liquidity providers using the fees collected.

A Uniswap liquidity pool works by enabling anyone to deposit a pair of tokens to a pool, then rewarding them for providing liquidity by equally paying participants with a 0.3% transaction fee.